32+ Mortgage calculator 10 year loan

1 day to 1 week. 1 day to 1 week.

2

Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff.

. Advantages of a 10-Year Fixed-Rate Home Loan. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. In a 30-year fixed rate mortgage the interest payment that we make is probably very close.

This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. Getting ready to buy a home. If rates are low like they currently are then the.

Well find you. 58 of borrowers choose a 2-year deal period while 32 opt for a 5-year deal period. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

See the results below. Across the United States 88 of home buyers finance their purchases with a mortgage. To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts.

Then initial payments on a 25-year loan term go mostly toward interest. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. Rates locked in for duration of loan lower rates than many other forms of financing due to being secured.

Whether you are buying an used car or finance for a new car you will find this auto loan calculator come in handy. Here are some of the advantages of a 10-year mortgage over. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

The big advantage of a 30-year home loan over a 10-year loan is a lower monthly payment. Todays mortgage rates in Texas are 5746 for a 30-year fixed 4897 for a 15-year fixed and 5205 for a 5-year adjustable-rate mortgage ARM. 5 year auto loan with good credit.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. However for those who can afford the slightly higher payment associated with a 10-year mortgage are getting a better deal in almost every possible way. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule.

All inputs and options are explained below. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period. Rates locked in for duration of loan.

Car loan calculator with amortization schedule and extra payments to calculate the monthly payment and generates a car loan amortization schedule excel. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Annual real estate taxes.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Jan 31 2038. The 366 days in year option applies to leap years otherwise.

5 year auto loan with bad credit. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

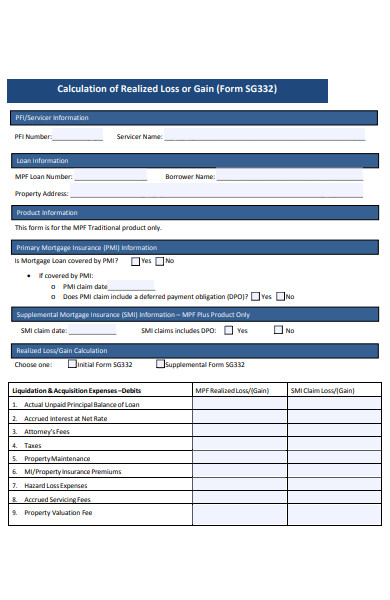

Free 31 Calculation Forms In Pdf Ms Word

Environmental Valuation Cost Benefit News May 2017

May 20 2016 Strathmore Times Pdf Sin Salvation

2

2

2

Mortgage Note 6 Examples Format Pdf Examples

2

2

2

2

2

0 Xxx Rayburn Rd Winlock Wa 98596 Lot For Sale For 375 000

Kinglet Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

2

Mortgage Calculator Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

New Student Loan Forgiveness Rules Under Covid 19 Cares Act Student Loan Planner